A Tougher road ahead for home buyers and sellers

Real Estate Market and US Housing Forecast 2019

It's an important topic home buyers and sellers who face a big decision about buying a home or condo in 2019. This 2019 US housing forecast offers facts, data, perspective, predictions, price factors, expert opinion, trends and housing forecast.

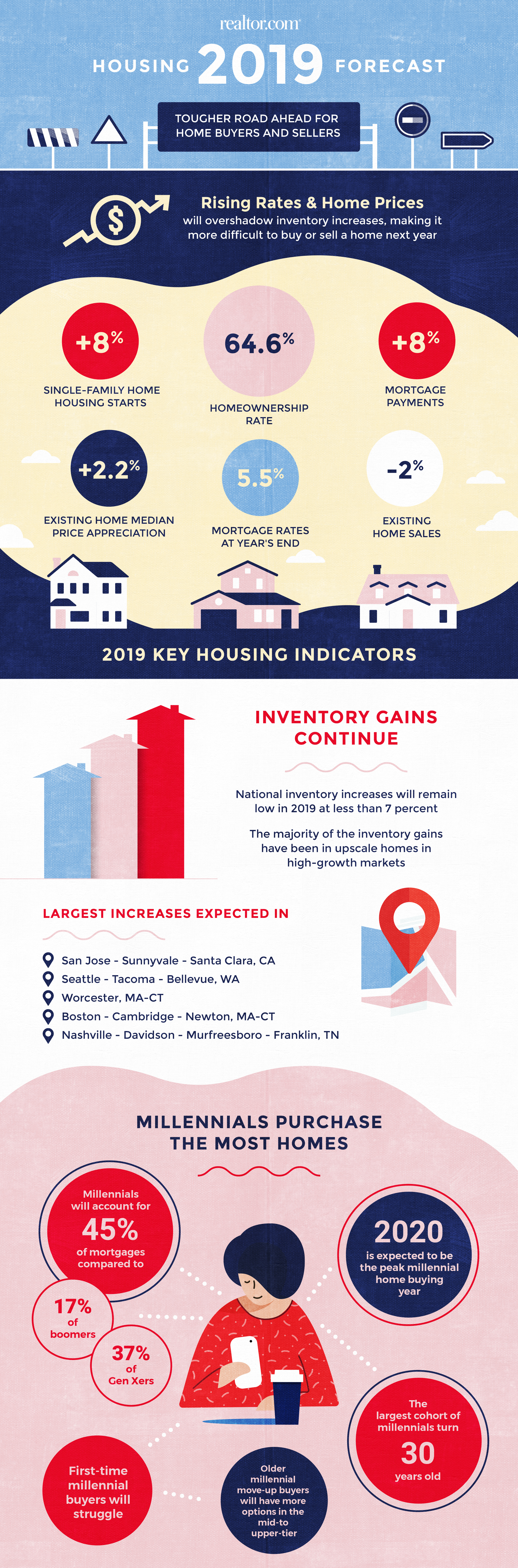

Housing Market Predictions for 2019

The housing market is forecast to see modest inventory gains in 2019, with mortgage rates expected to rise to 5.5 percent by end or year. Mortgage payments are predicted to rise 8% putting home ownership a bit more out of reach for the younger Gen-Z, Millennial, and many other first-time home buyers. However, upscale homes in high-growth markets will see opportunities for buyers.

Forecast Highlights

- Home price growth projected to continue to slow, with a forecasted increase of 2.2%

- Inventory increases will remain moderate with less than a 7% increase

- High-priced markets will buck the trend, with double-digit inventory gains

- Millennials will account for 45 percent of mortgages in 2019 vs. 17 percent for Boomers

- New tax plan will be good for renters, mixed for homeowners

Realtor.com® Forecast for Key Housing Indicators

Housing Indicator | Realtor.com 2019 Forecast |

|---|---|

Mortgage Rates | Average 5.3% throughout the year, reaching 5.5% (30 year fixed) by year end |

Existing Home Median Price Appreciation | Up 2.2% |

Existing Home Sales | Down 2% |

Single-Family Home Housing Starts | Up 8% |

Home ownership Rate | 64.6% |

Low Inventory Affecting Home Prices

Inventory will continue to increase next year, but unless a major shift in the economic trajectory occurs, don’t expect a buyer’s market within the next five years. Unfortunately for buyers, it’s only going to get more costly to buy in 2019. especially the most-demanded entry level real estate. To be successful, buyers should think through how they’ll adapt to higher rates and prices.

What will 2019 be like for buyers?

Buying a home will be an even more expensive undertaking in 2019 as mortgage rates and home prices increase. Buyers able to stay in the market will find less competition as more buyers are priced out. An increased sense of urgency to close before it gets even more expensive will be felt. Their largest struggle next year will be reconciling wants, needs and budget versus the heavy competition of 2018. Homes for sale is increasing, which is an improvement for buyers, majority of new inventory is in the mid-to higher-end price tier. Rising mortgage rates and prices will keep a lot of new inventory out of their budget and make it especially tough for first time home buyers.

What will 2019 be like for sellers?

Although it remains a seller’s market, there is a change from the past few years. Sellers should consider increasing competition and shouldn’t necessarily expect to name their price and get it in full. Above-median priced sellers, may find it will take longer to sell and require offering incentives. Incentives such as price cuts or other offerings may be required. With less demand in the market, there will be fewer bidding wars and multiple offers. However, with inventory expected to remain limited in most markets, sellers who price competitively can still walk away with a handsome amount of profit. However don't expect the price jumps observed in previous years.

Four Housing Trends in 2019

1) Modest inventory gains continue; high-end inventory growth spreads

Inventory hit the lowest level in recorded history last winter, but finally bottomed out and reached positive territory in October. National inventory increases will remain low in 2019 at less than 7 percent. In the majority of markets, the number of homes being put on the market or newly constructed has increased slightly, while the pace of sales has slowed slightly, which has helped stop the inventory decline. But the inventory increases or slowing price increases necessary for a more widespread sales gain are not forecasted to happen in 2019. While the situation is not getting worse for buyers, it’s also not improving notably in the majority of markets.

High-priced markets are a different story. The majority of the inventory gains have been in upscale homes in high-growth markets, which suggests higher prices are incentivizing sellers.

2) Soft home sales continue

After the best sales year in a decade in 2017, home sales are on track for a mild year-over-year decline in 2018, which is likely to extend into 2019 with a 2.0 percent decline. Although long-term desire to own a home remains strong, especially among younger Gen-z and millennials, the market challenges that make owning a home difficult continue to keep out first-time buyers, locking them out not only of their home, but also of the wealth by equity generation that owning provides.

3) Millennials purchase the most homes

Millennials will continue to make up the largest segment of buyers next year, accounting for 45 percent of mortgages, compared to 17 percent of Boomers, and 37 percent of Gen Xers. While first-time buyers will struggle next year, older millennial move-up buyers will have more options in the mid-to upper-tier price point and will make up the majority of millennials who close in 2019. Looking forward, 2020 is expected to be the peak millennial home buying year with the largest cohort of millennials turning 30 years old. Millennials are also likely to make up the largest share of home buyers for the next decade as their housing needs adjust over time.

4) Tax plan remains a wild card for housing

In April 2019, taxpayers will go through the income tax process for the first time since the new tax plan. For most renters, the results will be good: lower rates and a higher standard deduction should amount to lower tax bills. For homeowners, it’s a mixed bag. Some will benefit from lower rates and a higher standard deduction, but many others will find limited itemized deductions and personal exemptions mean a higher tax bill. Despite the fact that 2017 home sales were the highest they’ve been in over a decade, sales in 2018 started to decline immediately following the tax plan. While many factors influence home sales, it could be the case that without homeownership incentives some renters are holding off on buying. How the market will react in 2019 remains a wildcard for housing.

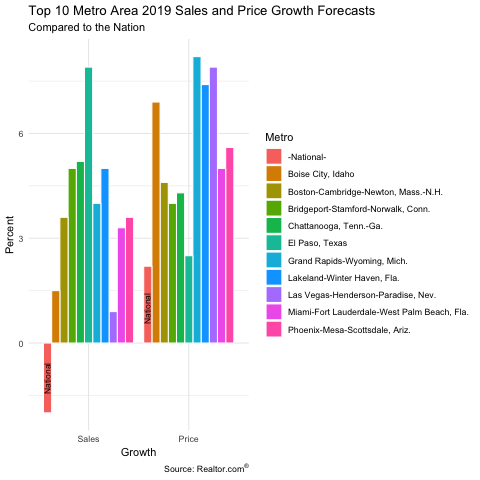

Top 10 Metro Area 2019 Sales and Price Growth Forecasts

You may wonder how well the top performing areas of the country will outshine the national average in our 2019 housing market forecast and what contributes to or drives this performance. This article addresses both of these questions, and follows up with an in-depth examination of how these operate in each of the top ten metropolitan areas.

Before proceeding, you should note that we determined the top ten areas by summing their sales and price growth forecast for 2019. To make it to the top ten, some are expected to have spectacular sales growth, others spectacular price growth, while still others are expected to have spectacular balanced growth.

How outstanding are these metro areas?

Both existing home sales and median sales price in each of these areas will grow at rates considerably above the national rate. Nationally, we expect sales to drop 2.0 percent, while on average we expect, the top 10 metro areas’ sales will increase by 4.0 percent. Nationally, we expect prices to rise by 2.2 percent, while on average we expect, the top 10 metro areas’ prices will increase 5.6 percent. We could describe how much they stand out, but a picture is worth a thousand words. Take a look at the bar chart. While sales will fall two percent at the national level, they will be growing one to eight percent in the top metros. Prices will grow two percent nationally, while they will grow three to four times as much in some of the metros.

What causes a metro area’s housing market to outperform the national average?

Several factors are common to most of the top 10, which create the conditions for particular markets to outperform the national average. On the demand side, these include, a growing economy measured in growing employment and income, growing population due to either in-migration or natural growth, and a high proportion of young couples at the stage of life of starting and growing families.

On the supply side these include affordable housing, available land, labor and capital for building new homes and an older population looking to downsize, move to senior facilities, move in with their children or have passed away leaving a home for their children to sell.

Three Factors and there indications

Growing economy – All but one of the top 10 metros is expected to have employment growth in 2019 in excess of the national average with an average of 2.1 percent for the top markets vs 1.3 percent nationally. Only half of the top 10 metros are expected to have income growth in 2019 in excess of the national average, however, the average for the top 10 (3.83 percent) is higher than the national average of 3.55 percent.

Growing population – Almost all of the top 10 metro area populations are growing faster than the nation. Only Boston, is not growing as fast as the national average. On average, the top 10 are growing 2.0 percent compared to 0.65 for the nation as a whole.

A growing young and Millennial population – A high proportion of the population that is at the right stage of life, with money, stability and the incentive of a growing family will be looking for a home to buy. For the most part, these are Millennials. This younger demographic is a net demander of housing, assuming they have the income, savings and stability to take the leap into homeownership. Millennials are expected to make up 45 percent of purchasers with a mortgage nationwide. As a proxy for Millennials, those aged 25 to 34 made up more than forty percent of recent mortgage purchasers in 4 of the markets projected to do well in 2019 and additional potential is there as Millennials age. Looking ahead, these markets are expected to see the population aged 35-44 grow by more than 5 percent over the next five years compared with 3.9 percent growth for the U.S. as a whole in this age group.

Metro area | percent millennial |

|---|---|

Lakeland-Winter Haven, FL | 32.0 |

Grand Rapids-Wyoming, MI | 48.8 |

El Paso, TX | 45.7 |

Chattanooga, TN-GA | 43.9 |

Phoenix-Mesa-Scottsdale, AZ | 31.9 |

Bridgeport-Stamford-Norwalk, CT | 33.8 |

Las Vegas-Henderson-Paradise, NV | 30.0 |

Boise City, ID | 32.4 |

Miami-Fort Lauderdale-West Palm Beach, FL | 29.9 |

Boston-Cambridge-Newton, MA-NH | 41.8 |

Milwaukee-Waukesha-West Allis, WI | 45.8 |

Note, the Millennial generation is currently 22 to 37 years old. These data reflect 18 – 34 year olds.

Boise City, ID

The Boise area comes in at eighth and similar to Las Vegas, will have relatively low sales growth of 1.5 percent and high price growth of 6.9 percent expected in 2019. It has a robust economy expected to grow over 7 percent in 2019, generating employment growth of 2.1 percent and income growth of 3.4 percent. The population and labor force are growing rapidly with the labor force growing over 3 percent in recent years, but expected to slow to 2 percent in 2019. Similarly, population has been growing at about 2.5 percent in the last few years, but will slow to under 2 percent in 2019.

Home prices ($258 thousand) are expected to be almost as high, as in Las Vegas, but so too are median household incomes ($59 thousand). Throughout the economic recovery, sales in the Boise area have steadily grown until recent years. During the recession, throughout the country, there was an unmet need for housing as couples formed and families grew, while their incomes and job stability plummeted. This resulted in a pent up demand for housing that has been satisfied during the recovery. In the Boise area, unlike many other areas, sales growth recovered soon and steadily grew throughout the recession.

Growing new home construction: Still Strong in 2019

Growing new home construction – In a growing population, the existing housing stock, by definition, is not enough to satisfy the demand for housing in the long run. New homes must be constructed to accommodate a growing number of households and to replace homes destroyed by natural disasters and dilapidation. Builders can supply these new homes

New Home Construction Still Strong

more easily in markets with readily available land, construction labor and capital to finance their operations. Most, but not all, of the top 10 markets have readily available land to build on. Eight of the top 10 are expected to see construction employment grow faster than the national average in 2019. The top 10 markets should have a 5.9 percent growth in construction labor compared to 4.1 for the nation as a whole.

On the supply side, this means that households, at the right stage of life, will be putting their home on the market either because they are looking for a larger home, are moving to another part of the country or are downsizing after becoming empty nesters. The older demographic is a net supplier of housing. They may move in with their children, head for a senior home or die off.

Inflation, Growth, Labor Shortages, and Building Supplies

When young people are buying their first home and older people are selling their last home in an area with no population growth or in or out migration, sales increase but not the total supply of homes on the market. For each starter home supplied to the market a larger home is taken off the market. With a constant population, first time buyers will roughly equal sellers at the other end of life. In growing markets, people are migrating from other parts of the country because of employment or other attractions. Buyers will exceed sellers and the inventory of homes on the market will decline, unless there is a robust new home construction industry. In declining markets, people are moving away and sellers will exceed buyers. Inventory will build and prices will fall. In some markets, particular demographics (growing number of young couples starting families and looking for a home or a large aging population and selling a home) will affect this balance.

Of course, population is not constant. It grows at a steady pace of about two-thirds of a percent each year in the nation as a whole. New homes must be constructed to supply this growing population. Add to this, a small percentage of homes, which need to be replaced each year because of damage from storms, fires or simply dilapidation.

Top 10 Markets are attractive to many

The top ten markets are attracting new households to their areas, because of economic opportunities, such as affordable housing combined with employment and income opportunities. Many also offer local amenities like warm climate, or natural attractions, such as mountains, the sea or lakes. Others offer cultural benefits found in large urban areas. Some of the top ten are also shedding households because of the high costs of living, especially homes.

An attraction to many of the areas is affordability. But this will be temporary if builders cannot keep up with the in-migration of households. Their ability to do so is dependent on the availability and price of land, the availability of skilled construction labor and for small builders the availability of small business loans to finance their construction projects.

The table below summarizes key indicators determining the potential for a growing housing market. These are the national figures. As you read the profile for each metro area, you may want to compare their figures against the national figures to get a sense of how much stronger the demand or supply component is than the national average.

INDICATOR | GROWTH |

|---|---|

Existing Single Family Home Sales | -2.00 |

Existing Single Family Median Home Price | 2.20 |

Existing Single Family Median Home Price | 1.32 |

Median Household Income | 3.55 |

Gross Domestic Product | 5.53 |

Households | 1.14 |

Housing Starts | 8.00 |

Unemployment Rate | 3.36 |

Civilian Labor Force | 0.78 |

Population | 0.65 |

Construction Employment | 4.14 |

Here’s 8 Reasons Why People Are Still Eager to Buy Real Estate:

- Home prices are appreciating and it’s a safe investment over the long term.

- Millennials need a home to raise their families.

- Rents are high giving property owners excellent ROI on rental properties.

- Flips of older properties continue to create amazing returns.

- Real property is less risky (unless you get over leveraged)

the economy is steady or improving (although Trump’s letting his enemies cause too much friction). - Foreigners including Canadians are eager to own US property.

- Bankrupt buyers are over their 7 year prohibition from the last recession and they can buy again.

Sources:

Sales and Price forecasts: Realtor.com

Mortgage Data: Optimal Blue

All Other Data: Moody’s Analytics